Read Mississippi Withholding On The Sale Of Real Property By A Non Resident Pdf

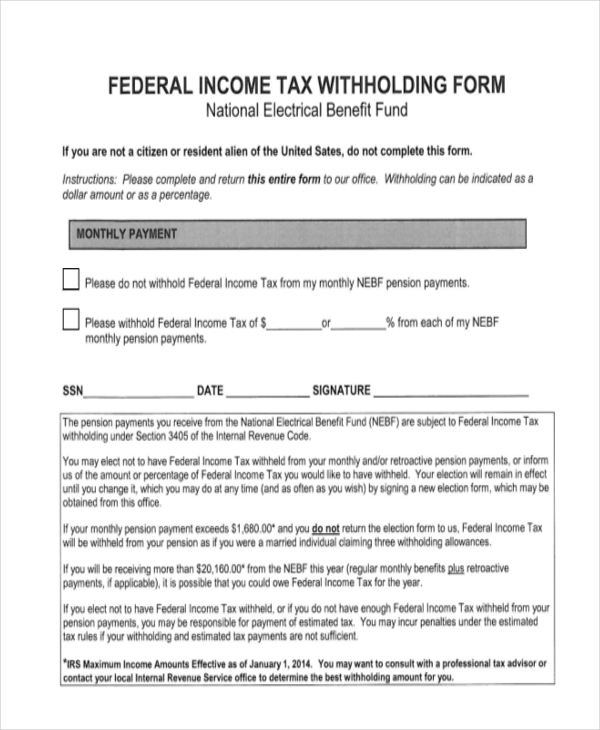

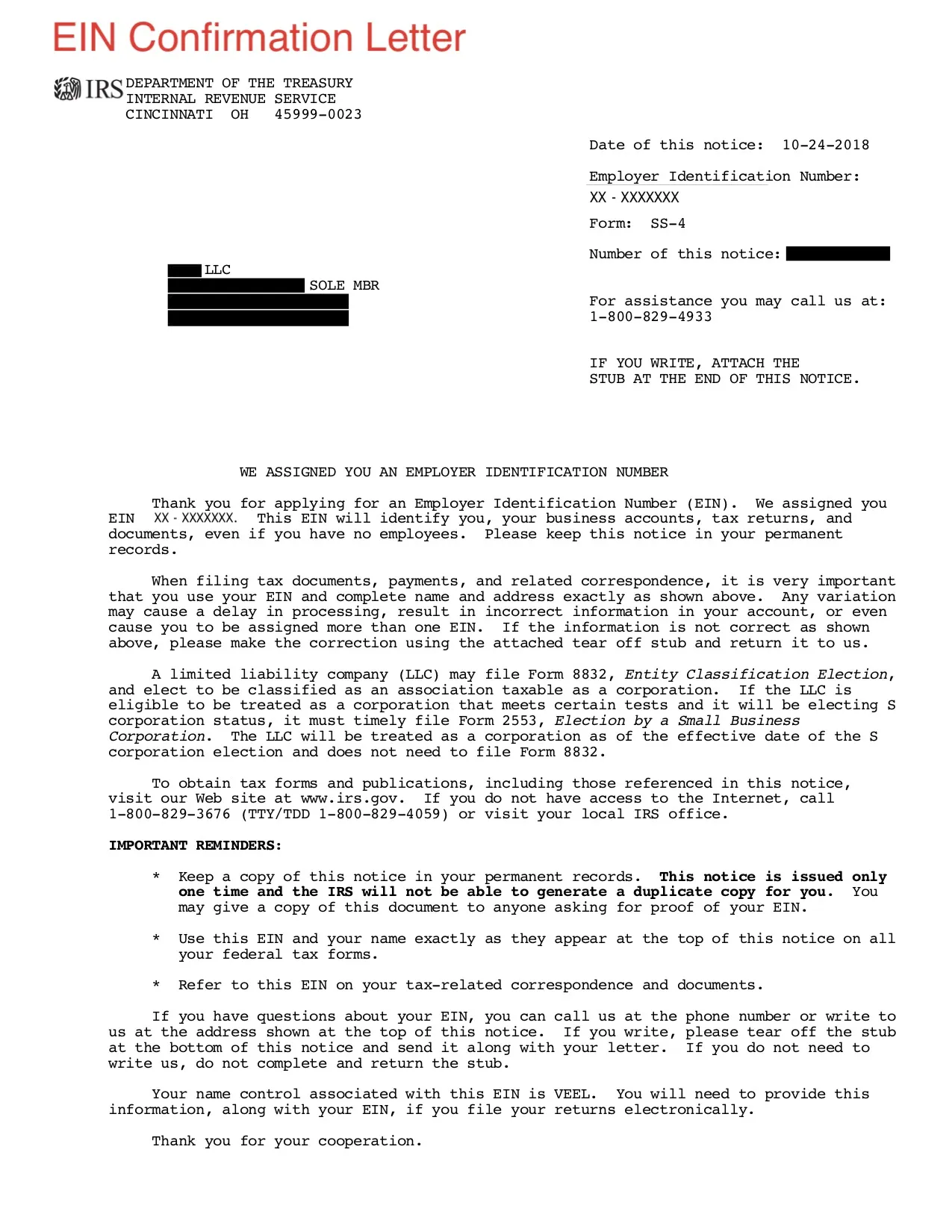

If the other state has an income tax the mississippi resident will have to file a non resident return in the other state and pay income tax to that other state.

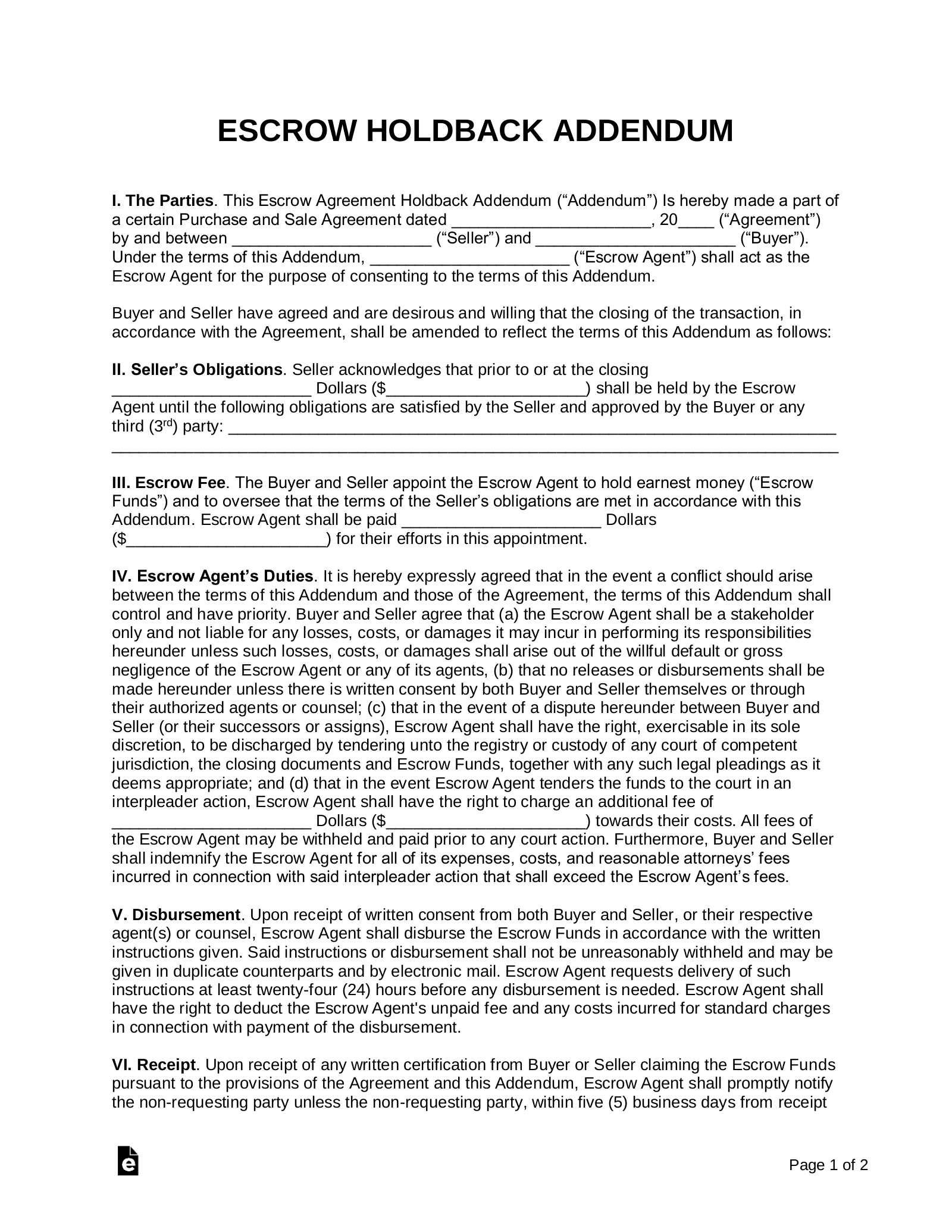

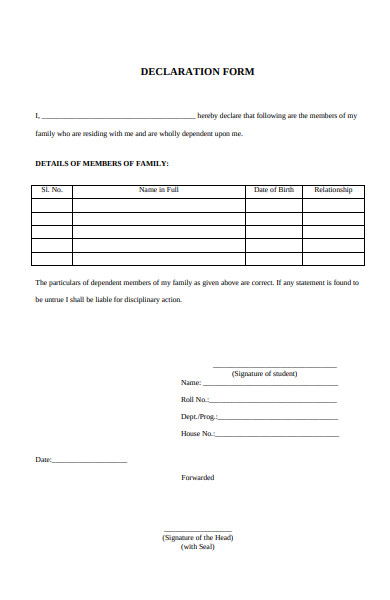

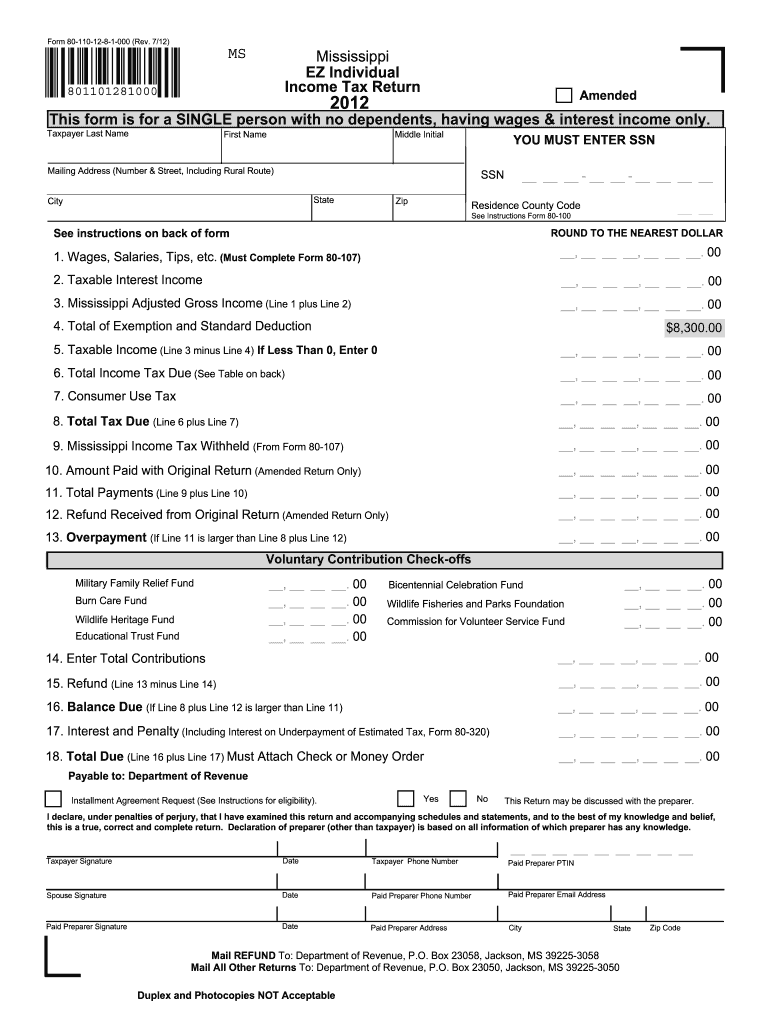

Read mississippi withholding on the sale of real property by a non resident pdf. A purchaser of real property and associated personal property from a non resident must withhold 5 of the gross proceeds of the sale when the gross proceeds of the sale exceed 100000. Mississippi withholding on the sale of real property by a non resident part 4 to be retained by the seller for his records. Application for tentative refund of withholding on 2020 sales of real property by nonresidents. Y y y y.

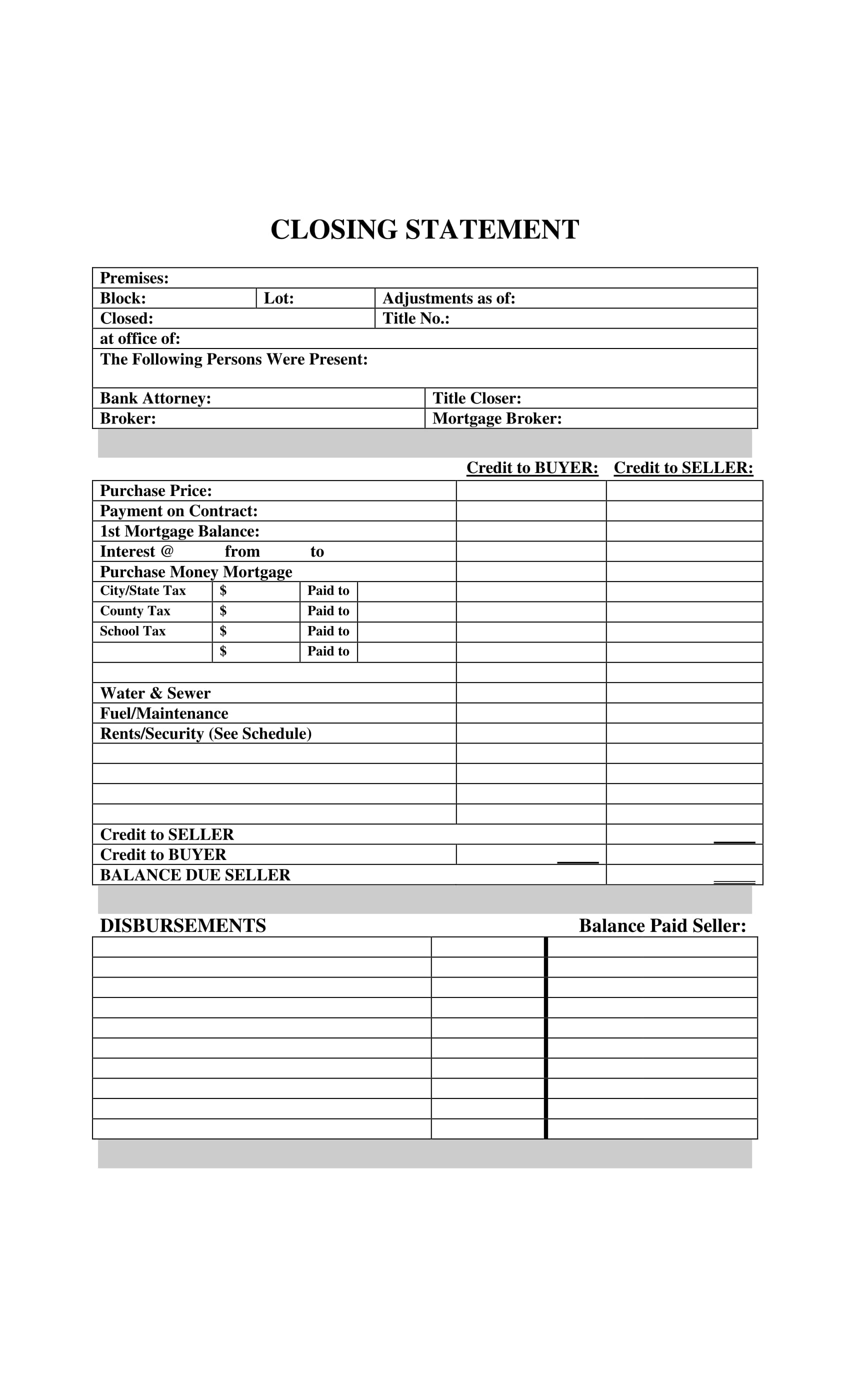

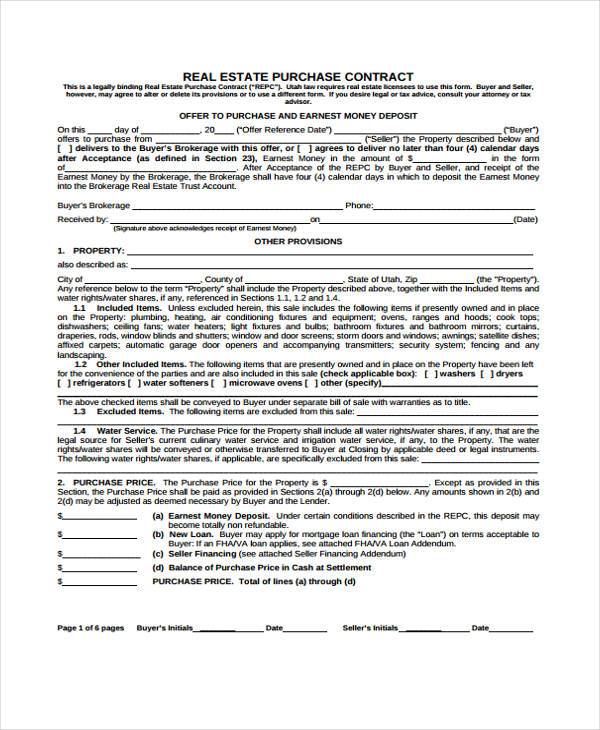

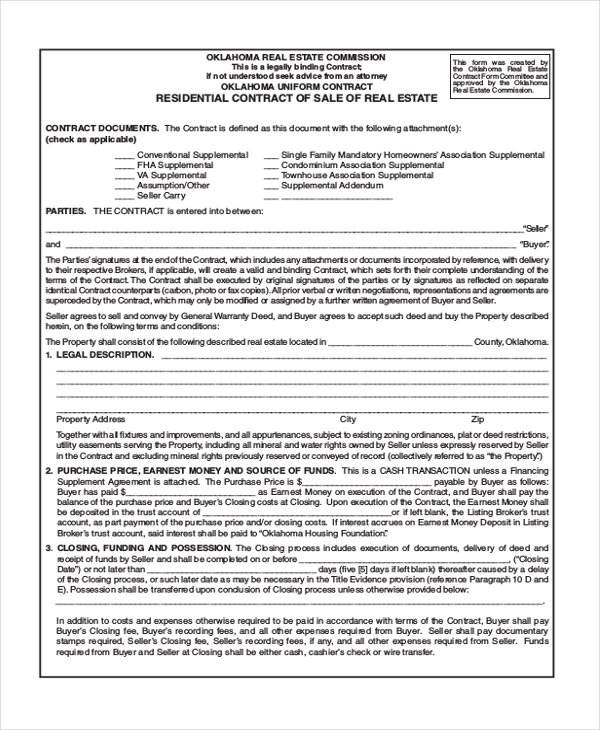

Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents and provide for tax collection at the time of the sale or transfer. Part 3 to be attached to the sellers return when credit is taken. Net proceeds payable to the seller line 3 minus line 4 enter here and on page 1 line 7 mississippi affidavit for withholding income tax on sale of real estate by non resident schedule a computation of gain schedule b computation of. Mississippi affidavit for withholding income tax on sale of real estate by non resident schedule a computation of gain schedule b computation of net proceeds only mortgages and liens on the property being sold may be deducted from the sales price.

Less mortgages liens or advances on credit lines not made in contemplation of the sale see above 5.